Solo 401k Contribution Limits 2025 Over 50. This is up from $66,000 and $73,500 in 2025. 401k limits 2025 over 50.

With employer contributions, you can get a whopping $69,000 into your 401 (k) in 2025, or $76,500 if you are 50 or older.

SelfDirected Roth Solo 401k Contribution Limits for 2025 My Solo, People aged 50 and older can. For 2025, employees can contribute a maximum of $23,000 to their roth 401(k) plan.

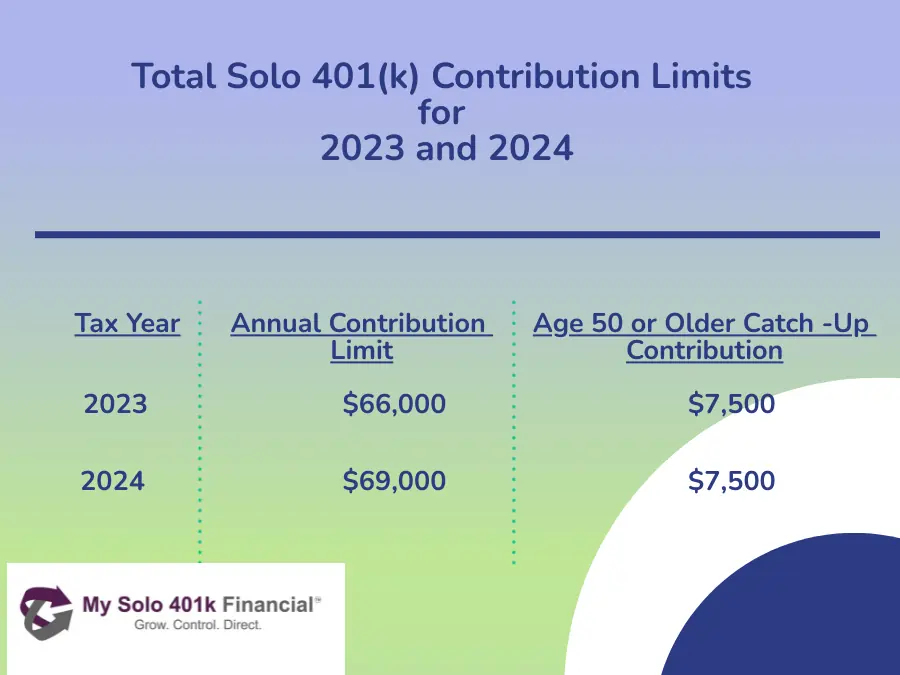

TotalSolo401kContributionLimitsfor2023and2024 My Solo 401k, You may be able to contribute up to $69,000 in 2025. For 2025, the solo 401(k) maximum contribution limit for the elective deferral is $23,000 if you’re age 50 and under.

What’s the Maximum 401k Contribution Limit in 2025? (2025), In 2025, the maximum you can contribute is $22,500 as the employee plus an additional 25% of earned income as the employer. With employer contributions, you can get a whopping $69,000 into your 401 (k) in 2025, or $76,500 if you are 50 or older.

Annual 401k Contribution 2025 gnni harmony, The maximum employee contribution for 2025 is $19,500 ($27,000 for individuals aged 50 or older). As the employer, you can make a nonelective contribution of up to 25% of.

401 Contribution Limits 2025 Over 50 Daron Emelita, Overall contribution limits (age 50 or over) maximum total contributions up to $76,500 ($69,000 annual additions limit, plus $7,500 salary deferral catch up contribution limit). Save on taxes and build for a bigger retirment!

Irs.Gov 401k Contribution Limits 2025 Anthe Bridget, For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. Retirement savers are eligible to put $500 more in a 401.

401k 2025 Contribution Limit Chart, Find out how much you can contribute to your solo 401k with our free contribution calculator. As the employer, you can make a nonelective contribution of up to 25% of.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, For 2025, you can contribute up to $69,000 to your solo 401 (k), or $76,500 if you're 50 or older. The term “401 (k)” is only used in the united states to refer to.

401k Contribution Limits 2025 Age 50 Heddi Kristal, In 2025, the maximum you can contribute is $22,500 as the employee plus an additional 25% of earned income as the employer. You can make solo 401 (k) contributions as both the employer and employee.

2025 Simple Ira Contribution Limits For Over 50 Beth Marisa, The 2025 401 (k) contribution limit for employees was $22,500. So, older workers can put a maximum of $30,500 into a 401.

For 2025, the solo 401 (k) maximum contribution limit for the elective deferral is $23,000 if you’re under age 50.