Mn Tax Refund 2025. For married couples, the standard deduction is $27,650 total if. We adjusted the special property tax refund so that if your property taxes increased by more than 6% from 2025 to 2025, you’ll qualify for a refund of up to $2,500, regardless of your.

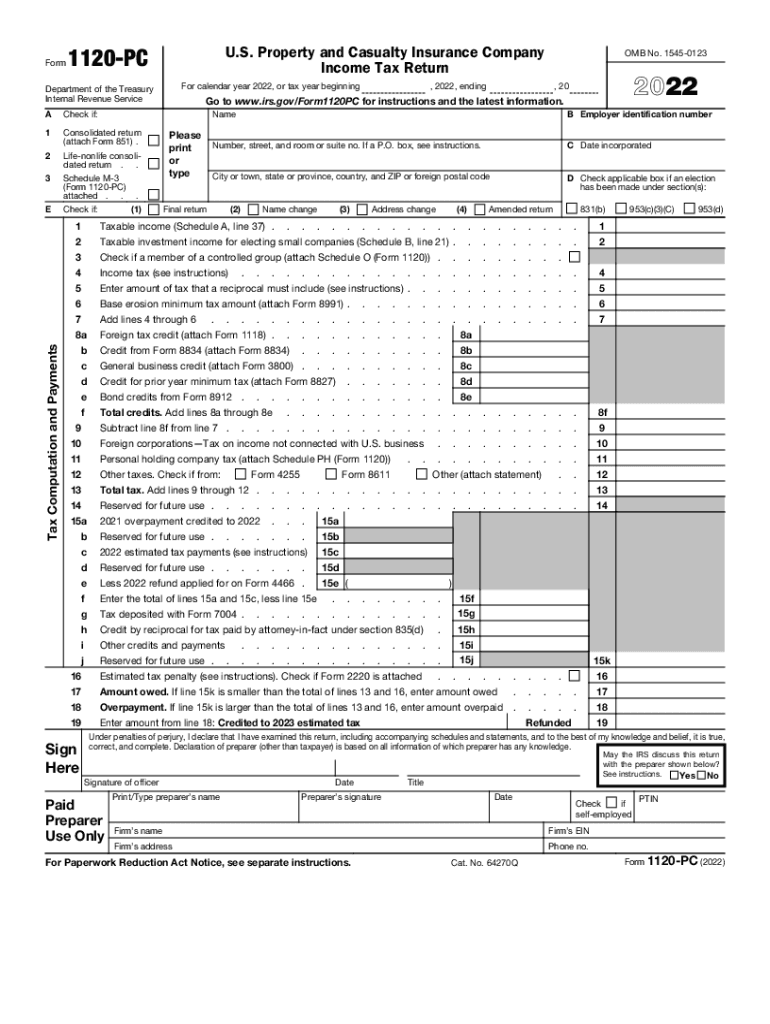

The irs issues more than 9 out of 10 refunds in less than 21 days. For married couples, the standard deduction is $27,650 total if.

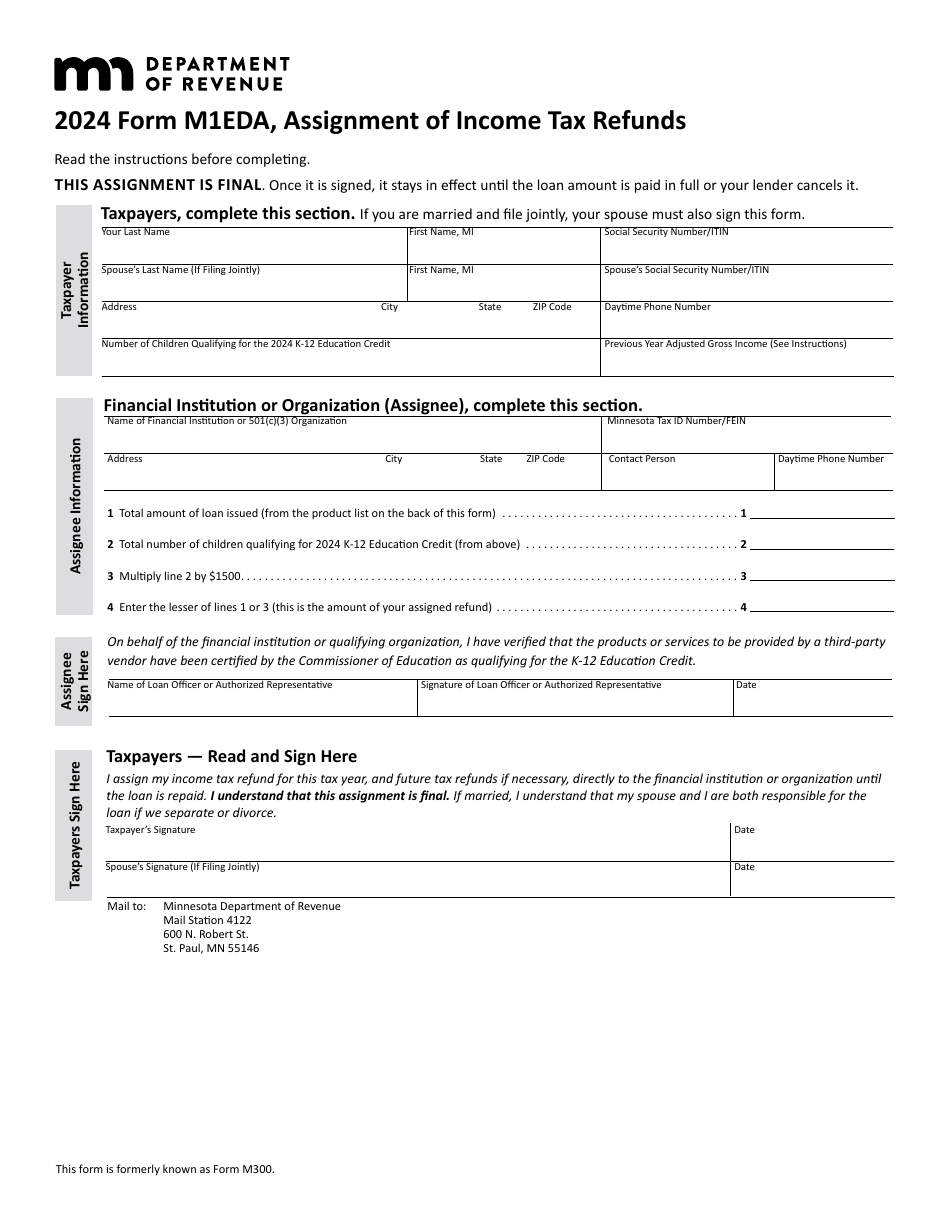

Form M1EDA Download Fillable PDF or Fill Online Assignment of, You may qualify for a renter's property tax refund depending on your income and rent paid.

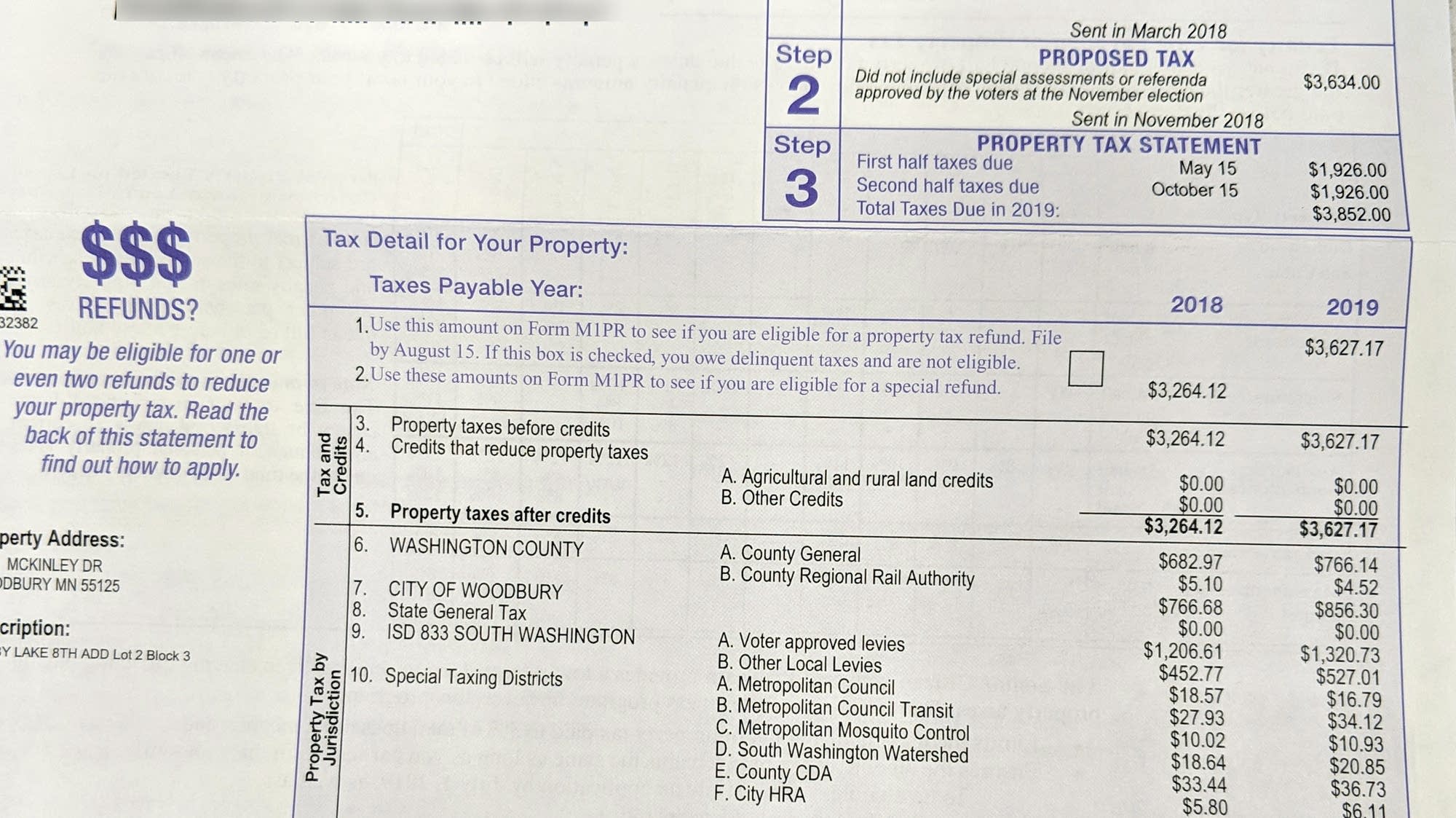

Mn Property Tax Refund 2025 Status Naomi Virgina, Homeowners with household income less than $135,410 can claim a refund up to $3,310.

Mn Property Tax Refund 2025 Instructions Nyssa Arabelle, You can have your refund directly deposited into your bank account.

Mn Property Tax Refund 2025 File Online Bekki Carolin, This rebate was part of the historic 2025.

Minnesota 2025 Property Tax Refund Form Rea Leland, The refund provides property tax relief depending on your income and property taxes.

Minnesota State Tax Refund 2025 Essie Jacynth, You may qualify for a renter's property tax refund depending on your income and rent paid.

How To Maximize Tax Refund 2025 Nara Leonie, Find information on how to file and pay your taxes, access free tax preparation assistance, and track your refund.

Mn Property Tax Refund 2025 Form Instructions Elfie Helaina, The irs issues more than 9 out of 10 refunds in less than 21 days.